CLEVELAND — Couple Monday's NCAA National Championship game in football and this upcoming weekend's start of the NFL playoffs along with the fact 30 states now offer legalized sports betting with New York state just introducing mobile sports betting and January has the potential to be a record-breaking month.

"Absolutely I think January is certainly setting up to be that and New York saw record numbers as everyone knows over the weekend with their launch of mobile and that's only half of the operators that are licensed in New York," said Casey Clark, Senior Vice President with the American Gaming Association.

"You know there's a lot of enthusiasm from New Yorkers to get into the legal market which is something you and I have talked a lot about and I'm sure Ohioans are kind of chomping at the bit to have that opportunity too," he said.

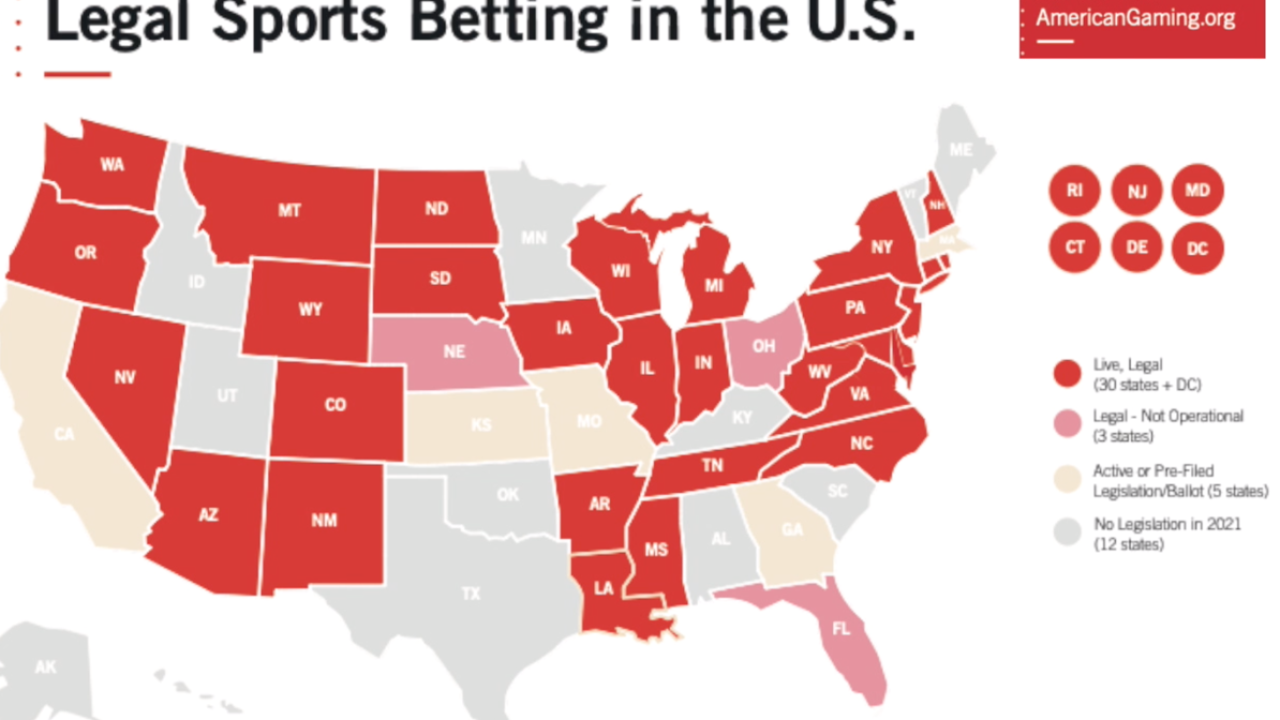

Ohio along with Florida and Nebraska are three states where sports betting is legal but is not yet up and operational. Governor Mike DeWine signed the bill into law last month.

"I said all along that I would sign a sports betting bill," DeWine told News 5. "I'm told by professionals and everyone who is looking at this that it is going to take some time to see it actually implemented in the state of Ohio. It could take up to a year."

The wording of the Ohio law states that sports betting be up and running in the state no later than January 1, 2023, but might it be sooner? DeWine said that door is open.

"I've instructed our administration as soon as everything is ready we should move forward with it, we don't want to hold it up, we want to follow what the law says and make this available to people but it's going to take some time for everything to be worked out before this can really start," DeWine said.

One of the things that need to be worked out will be taxes. Ohio set a tax rate on the sportsbooks of 10% after all bets are paid and that is in line with other states. What's not is that the tax rate is imposed daily - not monthly like in other states.

"It is unusual because largely these things happen on a month-to-month basis," said Clark. "Some days are up, some days are bad."

If a sportsbook took in say $100,000 one day and lost $100,000 the next that would balance out if things were figured out monthly but if done daily they'd have to pay taxes on that $100,000 win and get no credit for the loss.

In addition, money placed on a game several days out would count as revenue for that day, not the day the game was played so it would be seen as revenue even though it's a bet the sportsbook could eventually lose.

"And you don't get to offshoot your promotional costs which is permitted on a daily basis but if you're already losing there's nothing to counter that. So it's a difficult proposition for operators for sure," Clark said.

It's reminiscent of the tax fight in 2011 between the future casinos and then Gov. John Kasich when Kasich wanted to impose the state's CAT or commercial activity tax on every single wager. It was a fight that shut down construction on the casinos for a month. The Kasich administration and the casinos eventually struck the deal that actually cleared the way for VLTS or video lottery terminals at the state's seven racetracks.

The governor told News 5 everything is on the table.

"If there's things that need to be changed the legislature and I will discuss it and you know we'll look at making the changes so we're going to see how this works out," DeWine said of the tax. "So I think it's too early to make any kind of judgments about any changes that we should make."

Clark for his part agrees.

"I think that's going to all come together and get adjusted in 2022 and I'm excited about Ohioans finally having access to the legal market," Clark said.