LAKEWOOD, Ohio — If it feels like your money isn’t going quite as far as it once did, it’s because it isn’t. New data from the Bureau of Labor Statistics shows inflation in the month of January was 7.5%, the highest annual gain in four decades. Fighting a war on multiple fronts, including recovering from the pandemic, supply shortages, and online retailers, local small businesses are forced between two difficult choices: raise prices or accept smaller margins.

Located on Detroit Avenue in Lakewood, party supply retailer, It’s a Party, confronts the impacts of inflation on an everyday basis, owner Barbara Pennington said. When part of your retirement is tied up in inventory, it’s hard not to take everything personally.

“When I first opened, there was absolutely nothing here. There weren’t any shelves, any product, anything. My 401K is here,” Pennington said. “I don’t want to lose this. I just went through so much to get it started and I’m proud of myself because I was able to come into something like this and make it a success.”

Pennington launched her business on the doorstep of the Great Recession in 2008 but weathered and later thrived through the largest economic contraction in a generation. The past two years, however, have ushered in unseen challenges, namely the pandemic’s impact on gatherings, parties, and celebrations as well as continued supply shortages. Most recently, inflation and rising helium prices have been even more difficult.

“Last year and the year before, we had to put our own money in to say in business,” Pennington said. “You gotta keep laughing, you really do. Keep a sense of humor and stay positive.”

But it has been increasingly more difficult to stay positive, she said.

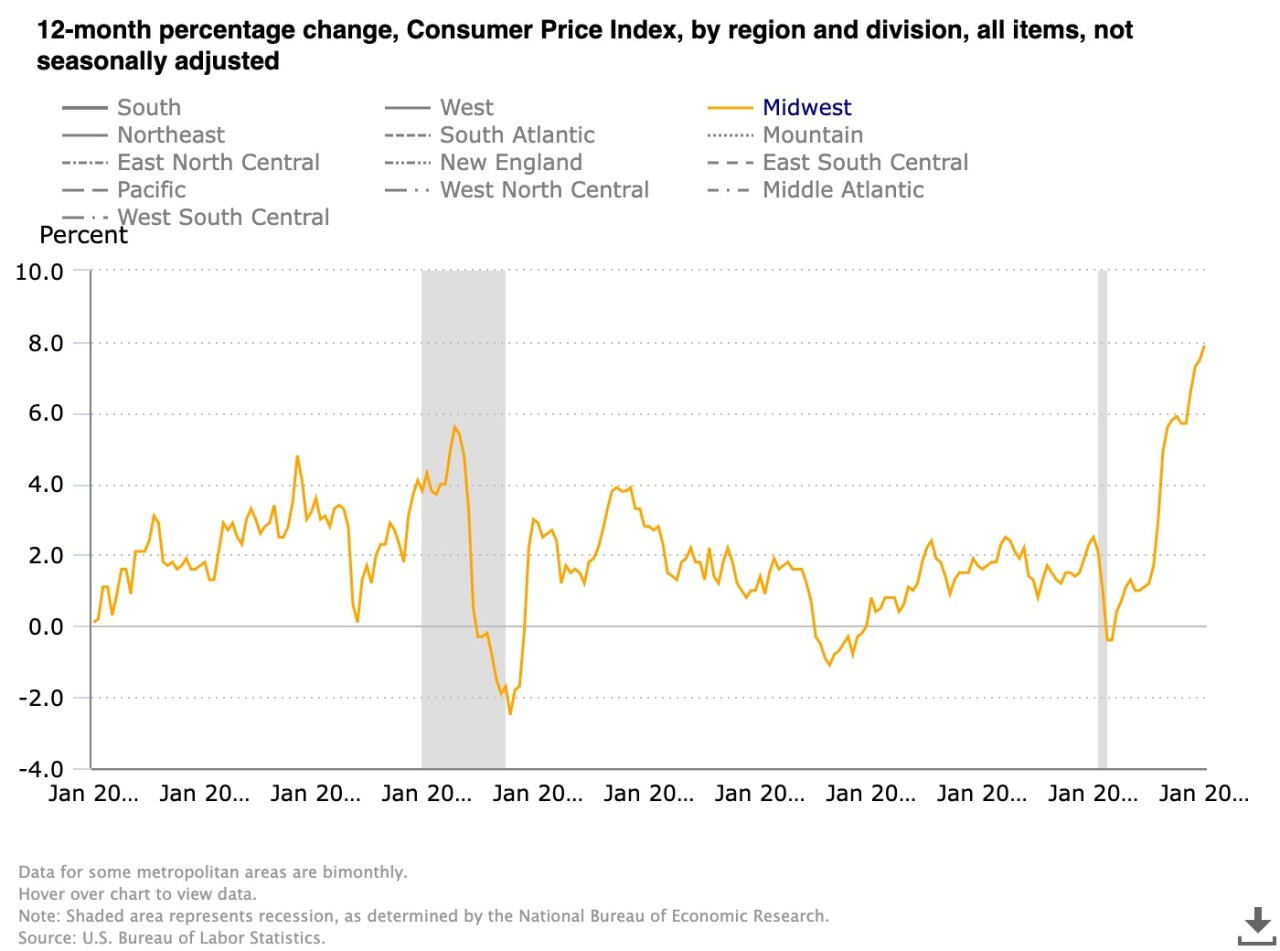

On Thursday, the federal government released the latest Consumer Price Index data, a tool used to measure inflation year-over-year. The CPI, which factors in a basket of commonly purchased goods like groceries and gas, was 7.5% higher in January 2022 compared to January 2021, the highest increase since 1982. Even after removing the traditionally volatile prices of groceries and energy, inflation rose 6%, higher than Wall Street analysts expected.

In the Midwest, inflation is even more pronounced, coming in between 8.2 and 9%, depending on location.

“The numbers out today in the rise in the CPI indicate that the rise in inflation continues to be concerning,” said Michael Goldberg, an associate professor at Case Western Reserve University’s Weatherhead School of Management. "I think there was some hope that as we hit 2022 that things would begin to get better but the combination of rising energy prices and rising prices all over, continued issues in the supply chain are creating a lot of problems for people in our community as well as our policymakers. I think individual consumers, folks in Northeast Ohio, are feeling this whole situation very directly. Their wages may be rising a little bit but they are feeling higher prices in the grocery store, at the pump, and their rental prices. They may be benefitting from higher wages but they’re paying it out of the same pocket with higher prices.”

According to market survey company, KPMG, grocery costs are expected to be 14% higher in 2022. Additionally, the National Federation of Small Businesses recently released survey data showing more than half of small businesses have been forced to raise prices to combat inflation. In Pennington's case, rising inflation has manifested in increased costs coming from her suppliers, Pennington said. Presented with the difficult decision of either raising prices or smaller margins, Pennington has leaned toward smaller margins as of late, all while trying to stay competitive with big-box party supply retailers.

“A [longtime repeat customer] came in every year until last year. We had gone up from $4, almost $5, to $13 and she said no. That was the first year she didn’t get [balloons for her child’s birthday],” Pennington said. “I go with what my customer can afford. I figure a little money is better than no money so I have to go to that customer.”

Despite the stress and anxiety of trying to navigate the pandemic and economic recovery, there is nowhere Pennington would rather be.

“You just have to stay positive even if sometimes it’s hard to do,” she said.